A quick update on the Shiller P/E predictions–been a slew of articles/research on this recently:

We’ve written fairly extensively on the topic of predicting future returns:

Here is an article we wrote up describing Hussman’s model:

John Hussman has an interesting piece on predicting long-term market returns

The article is a bit dated (2005), but still fascinating.

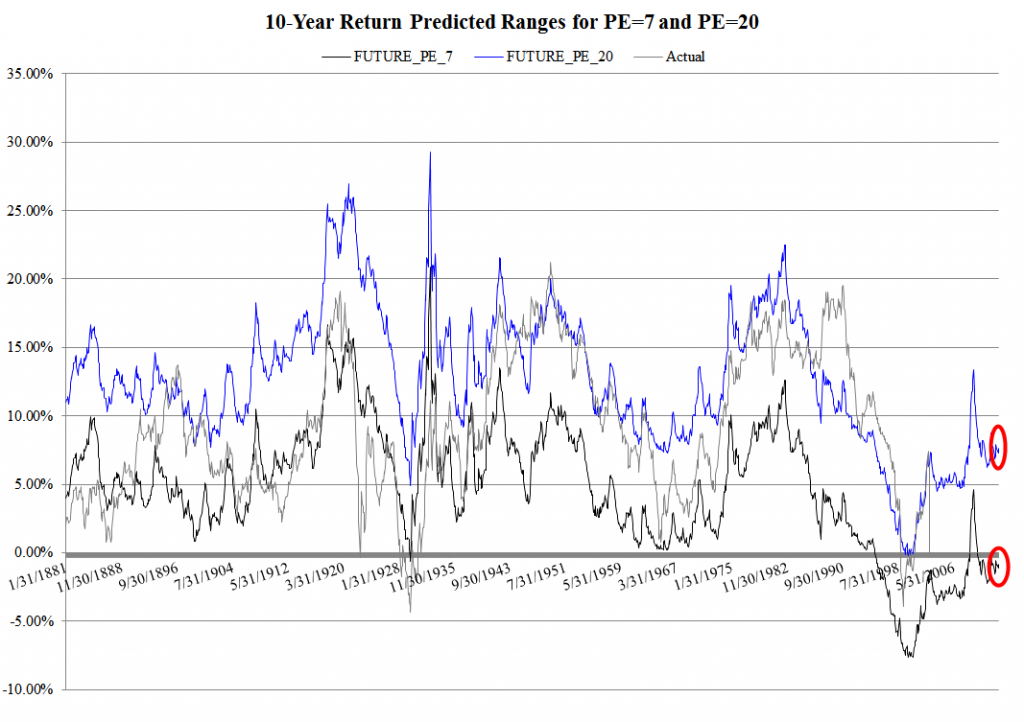

In the short piece Hussman suggests that the projected annual total return on the S&P 500 over T years can be represented with the following equation:

- Long term total return = (1+g)(future PE / current PE)^(1/T) – 1 + dividend yield(current PE / future PE + 1) / 2

He makes the following assumptions and plugs them into the equation above:

- Peak to Peak earnings growth, g=6%

- T=10 years

- future PE (E=Peak Earnings over cycle) range between 20 (major bull) and 7 (major bear)

Here are the results of our analysis of this model:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Low-end prediction is -0.84% 10-Year CAGR; high-end prediction is 7.61% 10-Year CAGR

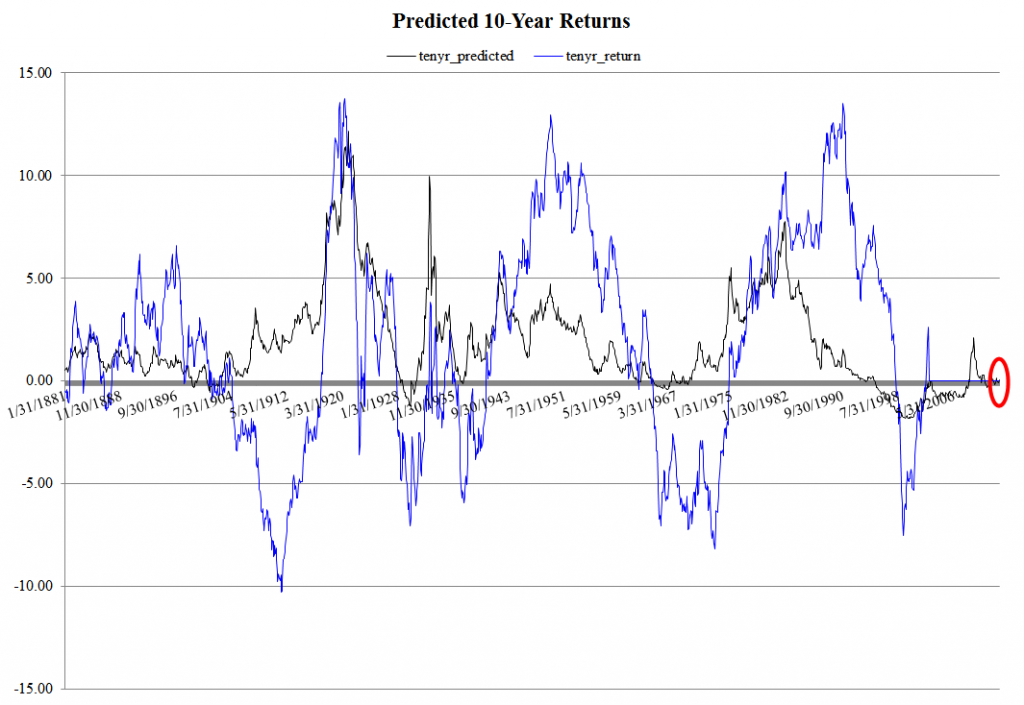

We also have a piece that is related to predicting 10-year returns with a simple regression model:

http://hlb.wax.mybluehost.me/2011/10/the-shiller-pe-ratio/

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The model is predicting a 3.31% 10-Year CAGR.

Summary

Expect 10-year returns to fall in the -.84% to 7.61% range over the next 10-years. Not too precise, but at least you can scratch off your prior expectation of 20% CAGR…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.